2024 Employee Business Expenses Deduction – You have to have a business I know this may sound you could deduct some work-related expenses even as an employee. That deduction is gone for the time being, but it may come back after 2025. . Taxpayers can only deduct the portion of their Internet their Internet access costs on the IRS form 2106 for employee business expenses. The IRS defines an “ordinary” expense as one .

2024 Employee Business Expenses Deduction

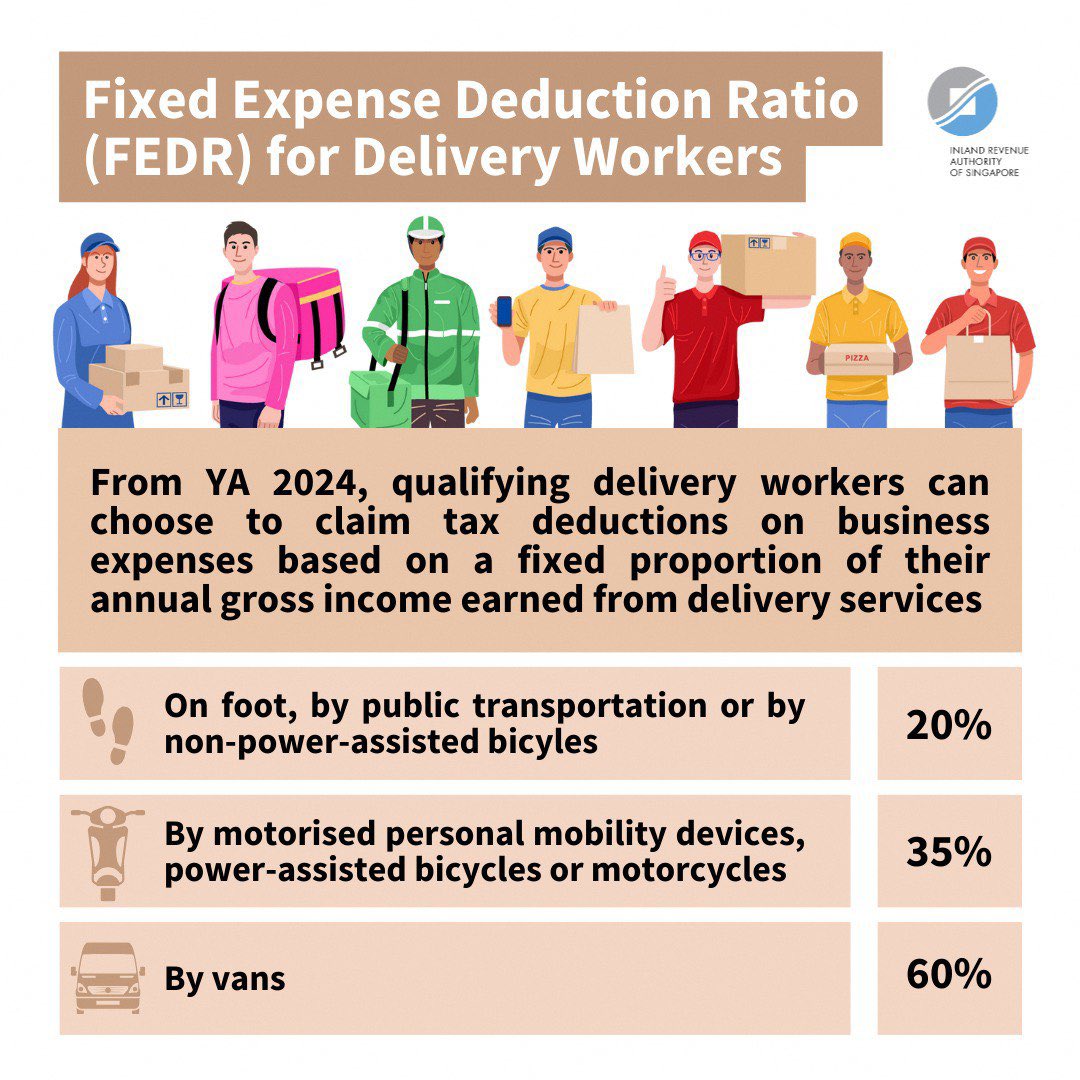

Source : www.freshbooks.comIRAS on X: “Good news for delivery workers! 🙌🏻 With effect from

Source : twitter.comSmall Business Expenses & Tax Deductions (2023) | QuickBooks

Source : quickbooks.intuit.com2024 State Business Tax Climate Index | Tax Foundation

Source : taxfoundation.orgSmall Business Expenses & Tax Deductions (2023) | QuickBooks

Source : quickbooks.intuit.comThe Ultimate 2024 Tax Deductions Checklist for Insurance Agents

Source : blog.newhorizonsmktg.comThe Best Business Mileage Tracker Apps for 2024

Source : www.fylehq.comMeal and Entertainment Deductions for 2023 2024

Source : ledgergurus.comThe Ultimate 2024 Tax Deductions Checklist for Insurance Agents

Source : blog.newhorizonsmktg.comMcDaniel & Associates, P.C. | Dothan AL

Source : www.facebook.com2024 Employee Business Expenses Deduction 25 Small Business Tax Deductions To Know in 2024: The biggest deductions for work expenses are restricted to self-employed people and small business owners, but some full-time employees can get a few tax breaks too. If you’re one of the many . Use tax deductions to your advantage. If you reimburse an employee for gas he puts into a company vehicle, reimburse the employee in cash, using a business expense accounting code that isn’t .

]]>